The W-8 form is a tax form reserved for non-US residents earning an income from a US-based company like Chatterbug.

Why is it important?

The W-8 form provides our non-US tutors an exemption from traditional US taxes since they already pay them in their respective country of residence. In order to be paid, every tutor living outside of the US needs a W-8 form on file.

How do I submit a file?

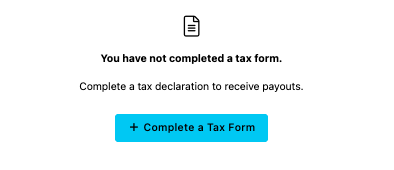

The form can be filled out online. Just go to your payout page where you manage your payment details. There, you find a new widget: + complete a tax form

If any certification on the submitted form becomes incorrect (e.g. after a move) the tutor has to reach out to tutor management within 30 days and needs to submit a new or updated form.

More information

More questions about the W-8 form? Please use the chatbox in the bottom right corner of your screen, or email us at help@chatterbug.com.

Please mind: All Chatterbug tutors are independent contractors and therefore responsible for their own taxes according to their country of residence. We will do our best to provide you with the correct form and information you need to make your own decisions to fill it our correctly. However, we don’t provide tax, legal or accounting advice. If you still have questions after reviewing the information provided by Chatterbug or the IRS, please contact your own tax, legal and/or accounting advisor prior to completing the form.